Linux headed for worldwide smartphone domination

Jan 26, 2004 — by LinuxDevices Staff — from the LinuxDevices Archive — viewsLinux may become the preferred operating system in a full-featured mobile device and handset market in which “there is no economic reason to question why growth will not be explosive,” according to Seamus McAteer, senior analyst and managing partner, Zelos Group. “The mass adoption of full-featured handsets will be disruptive,” adds McAteer.

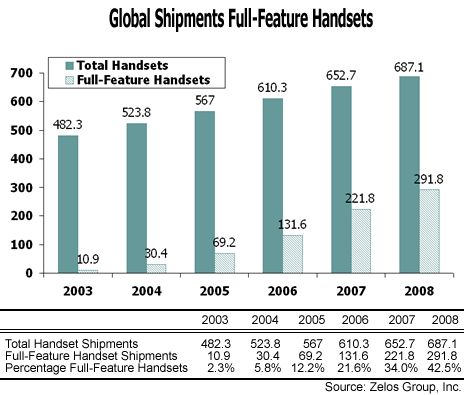

McAteer is author of a Zelos Group report, Defining the Market for Full-Feature Handsets, which forecasts annual sales of 290 million, or 43 percent of the global handset market, by 2008 for full-featured handsets — mobile phones that incorporate full-featured operating systems.

McAteer believes full-featured handsets will have a disruptive impact on the entire mobile electronics sector, because consumers will buy them instead of PDAs, digital cameras, gaming consoles, and music players. “An early indication of this is [mobile phone giant] Nokia becoming a leading distributor of digital cameras,” says McAteer.

McAteer expects portable device category leaders like Sony, Apple, Nintendo, Hewlett-Packard, and Casio to respond to the competitive threat from handset OEMs by improving core functionality of special purpose devices, and by adding mobile WAN connectivity.

“As handsets with multiple gigabytes of storage are launched in the next two or three years, it is possible to envision, for example, Hewlett-Packard launching an iPod with integrated W-CDMA transceiver and dual-use headset and speaker,” observed McAteer.

Zelos Group expects that shipments of full-feature handsets will overtake shipments of personal computers in 2006, when full-featured handsets will cost as little as $157 and the mobile phone market average will be about $138.

Technology Battlefield

McAteer sees mobile handsets as “the largest single consumer electronics category driving research and development in electronics, power, and display technologies,” making it a major battleground for computing operating systems.

“The market for full-feature handset platforms will continue to be highly competitive over the next five years,” comments McAteer. “In the medium term, the battle will be dominated by Symbian. But in the long term, the fight for supremacy is far from over.”

Based on Zelos Group's analysis, the long-term prospects for Linux as the preferred operating system for connected devices are “very strong.” Zelos Group scored all mobile platforms across five criteria: business viability, completeness, cost, end user appeal and openness. Linux scored highest on the two criteria that matter most to OEMs and carriers: openness and low cost. Microsoft scored lowest in these criteria.

Although Microsoft will be a powerful contender against Symbian in the next two years, it will not dominate the market in the long-term. Microsoft will seek a premium for the Windows brand and will seek to promote its own proprietary take on open standards.

“Symbian beats Microsoft due to the flexibility of its licensing terms,” commented McAteer. “Microsoft's prospects will be stymied to an extent by its desire to strictly manage how its brand is used. Although we expect at least five million Windows mobile devices to ship in 2004, we find it doubtful that Microsoft will succeed in its stated goal of shipping over 100 million mobile devices running Windows in 2007.”

Zelos and McAteer have supplied the following “key findings:”

- Full-Feature Devices Define the Mainstream — Devices based on full-feature operating systems will define the next stage of technology evolution in the mobile handset market. Sales of full-feature handsets will grow to about 290 million in 2008, or 42.5 percent of all handsets, from about 10 million in 2003. Sales will be driven by falling components costs that will result in full feature handsets at manufacturer price points of about $180 in two years and $120 in 2008.

- Linux will Threaten Symbian Dominance — While Symbian will be the market share leader in the next 24 to 36 months, thanks to its endorsement by market makers Nokia and NTT DoCoMo, Linux will threaten for long-term dominance. Linux leads other platforms in openness and low cost – factors that are essentials to success in a market defined by tight margins, rapid innovation, and standards adherence.

- Microsoft Must Broaden Appeal of Windows Mobile — Microsoft will face a severe uphill battle to succeed in its stated goal of achieving global shipments of 100 million devices based on its platform in 2007. While Windows will provide advantages for OEMs in the productivity device segment Microsoft will have a tough time defining new hybrid device categories and matching the innovation of more open platform ecosystems.

- Carrier Channel Control will be Endangered — By distributing full feature handsets carriers will create new service opportunities but will also create new competitors. The proliferation of full feature handsets with flexible I/O (input/output) will yield new channels for providers of handset features and content publishers using OTA download, PC synchronization, or retail distribution via memory cards.

- DRM will not Stymie Flood of Piracy — The proliferation of full-feature devices will create a major new venue for content piracy. Pirates will be attracted by the ease of distributing to open platforms and the higher production quality supported on full-feature handsets. Tighter DRM will help but will not totally assail pirates and others that will test the legal bounds of fair use of digital content.

- Mobile Electronics Sector will be Redefined — The use of full-feature operating systems will yield markets for hybrid devices including handsets that are optimized for productivity, imaging, game play and music consumption. Leading providers of mobile devices will be forced to respond by touting improvements in core functionality and facilitating WAN transmission via a Bluetooth-bridge or through direct integration of cellular modems.

- Embedded Platforms Will Survive — Full-feature platforms will be viewed as overkill by some manufacturers for market segments that lack the interest in, or financial ability to subscribe to, data services. Full-feature platforms will be competitive with embedded OSes such as Nucleus or ITRON in design wins for devices that will represent 50 percent of market shipments in 2008.

- Developers will Reassess Value of Java — While vendors highlight support for device middleware such as Java developers will shift their focus to develop natively for full feature OSes as their installed base grows. Developers will be attracted to consistent implementation, higher performance and less restrictive native platforms.

The full report is available directly from Zelos Group, for $1,495.

Zelos Group is an independent research and advisory services firm that assists technology companies and service providers in the interactive services sector. Its studies are internally funded, and based on primary research, according to a Zelos spokesperson. Zelos was founded in 2001, and has seven analysts.

The above chart and portions of the above text are copyright © 2004 Zelos Group. Reproduced by LinuxDevices.com with permission.

This article was originally published on LinuxDevices.com and has been donated to the open source community by QuinStreet Inc. Please visit LinuxToday.com for up-to-date news and articles about Linux and open source.