Snapshot of the Embedded Linux market — March, 2004

Mar 17, 2004 — by LinuxDevices Staff — from the LinuxDevices Archive — 6 viewsThe results of LinuxDevices.com's fourth annual Embedded Linux Market Survey are in! This brief summary outlines our interpretation of a few key data points. Overall, we find the results encouraging for embedded Linux as a whole, and for companies in the embedded Linux OS and tools market.

Last year, we ended our survey after three months, with nearly 600 respondents. This year, we received a similar number of responses in just six weeks, evidence of increasing interest in embedded Linux — and increased readerships for both our Website and opt-in newsletter.

As we did last year, we encourage readers to draw their own conclusions from the complete survey response data. Complete data and summary findings from last year's (2003) study are also available for comparison, along with many other market research reports (see “For further research” section below).

Please note that while we make every effort to increase result validity by limiting responses to a single submission per IP address, respondents are self-selected, and we have minimal control over multiple or dishonest voting. Additionally, our market share results are not meant to reflect upon the commercial success of individual companies. For commercial marketshare figures, LinuxDevices.com recommends VDC, EDC, IDC, ABI, and DataQuest/Gartner among other capable sources.

And now, our observations . . .

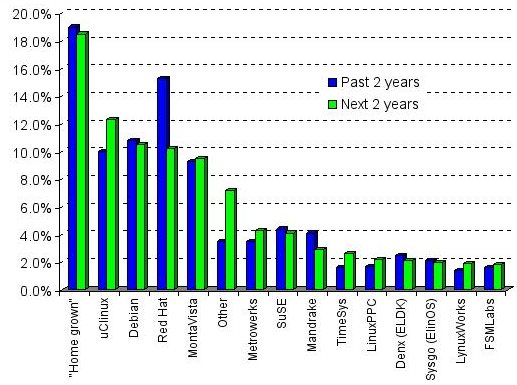

Asked where they got Linux for use in projects past and future, the majority of respondents cited sources other than embedded Linux vendors. The most popular Linux source was “Homegrown” (downloaded from GNU/Linux sources), chosen by 19 percent of respondents, with uClinux, Debian, and Red Hat next. The most-cited embedded Linux vendor, MontaVista, was chosen by just 9.3 percent of respondents.

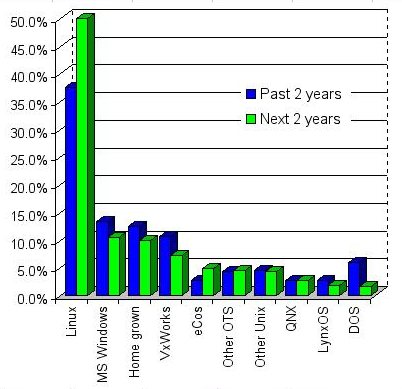

What forms of Linux have been in your (company's) embedded systems during the past two years? (blue) During the next two years? (green)

Homegrown and uClinux, the most popular choices, are freely available to developers. Several non-embedded specific distributions, including Debian and Red Hat, are also popular, offering the convenience of packaging, pre-testing, and upgrades at low or no cost.

The popularity of free or relatively inexpensive Linux sources may reflect developer cost consciousness, or perhaps simply the self-reliance and independence of developers in a market historically dominated by “roll your own” operating systems (as this chart in this article shows). Instead of rolling their own OS from scratch, embedded developers now roll their own OS from Linux source.

Embedded Linux sourcing trends

The barchart above illustrates that, collectively, embedded Linux vendors including MontaVista, Metrowerks, TimeSys, Denx, Sysgo, LynuxWorks, and FSMLabs have supplied Linux for only about 22 percent of projects during the last two years, projected to reach 24.2 percent over the next two.

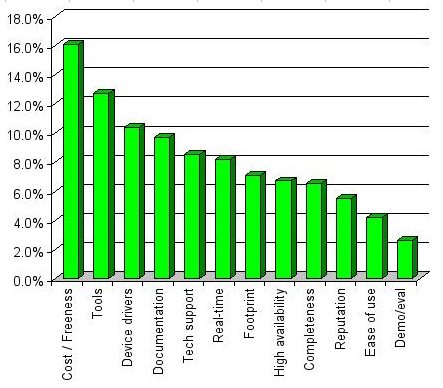

Last year, our survey suggested that developers care more about tools than any other factor when choosing a source of Linux for embedded use. However, a number of respondents emailed us wishing that “cost” and/or “freeness” had been included as an option. This year, we added a “Cost/Freeness” category, and it trumped the field — chosen by 16.1 percent of respondents as the top factor in selecting an embedded Linux starting point.

Which factor(s) will have the greatest influence on your choice?

Tools was the second most-cited factor, chosen by 12.7 percent of respondents, down from 14 percent last year. The high concern with tools may suggest overall dissatisfaction with available embedded Linux tools, as a March, 2003 EDC study suggested. Or, it may simply mean that high quality tools are — and will continue to be — a top priority in embedded development.

The slightly lower importance rating of tools this year relative to last year could reflect the emergence of the Eclipse platform, more mature tools releases from various embedded Linux vendors, and the entry of embedded tools giant Wind River into the embedded Linux tools market. Certainly, development tools is an area that has been receiving lots of attention from the embedded Linux vendor community during the past year.

Device drivers and documentation also rated high, chosen by 10.4 percent and 9.7 percent of respondents, respectively.

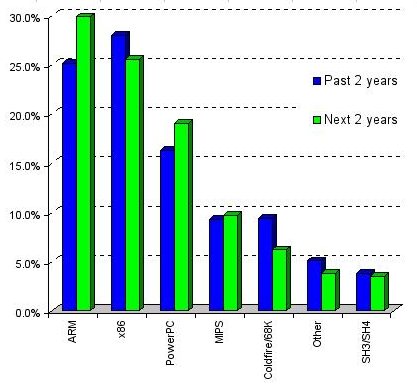

Last year, we noted that ARM — including StrongARM and XScale architectures — was gaining on x86 as the most popular processor architecture for embedded development. This year's results show that trend continuing. And, for the first time, embedded Linux developers are projecting that they'll base more projects on ARM than x86 processors in their projects during the next two years.

What CPU(s) have been in your (company's) embedded systems during the past two years? During the next two years?

As in past surveys, we asked about our respondents' willingness to pay for development support, and, separately, their willingness to pay runtime royalties for an embedded OS. As in past years, a marked preference for the former is evident.

Would you consider paying per-unit royalties? (left) For Linux development/support services? (right)

In some cases, companies may prefer runtime royalties because costs can be deferred somewhat, becoming part of the bill of materials rather than being an up-front development cost. However, most of those surveyed clearly prefer the simplicity of per-seat licensing and support fees.

A scant one percent of respondents said SCO's anti-Linux threats had significantly dampened their interest in using Linux in an embedded application or device.

Have SCO's anti-Linux threats dampened your interest in using Linux in an embedded application or device?

Even if SCO's wild threats held merit — and unfolding events suggest they don't — embedded systems would likely be less affected, according to analysis from MontaVista and others.

At LinuxDevices.com, our focus is on embedded Linux, so it is hardly surprising that Linux consistently shows up as the most commonly used embedded operating system among our readers, with a rapidly rising rate of adoption.

Linux dwarves other embedded OSes

Our results suggest embedded Linux will continue to grow quickly, at the same time that usage of most other embedded OSes declines.

Another embedded OS slated for growing usage, our results suggest, is eCos, a free, open source embedded OS that recently unified its copyrights under the Free Software Foundation.

While our results may be skewed by our Linux-oriented readership, research firms Gartner/Dataquest Gartner/Dataquest and EDC have found similar results regarding projections of embedded Linux growth in surveys administered to embedded developers.

Research findings from industry analysts:

- Gartner/Dataquest: Embedded Linux now number one in Asia

- EDC: Embedded Linux remains #1 choice of developers — despite tools dissatisfaction

- Findings from EDC's Embedded Developer Survey — August, 2003

- Linux, Windows neck-and-neck in embedded

- Embedded Linux tops developers' 2002 wishlist

- Study finds 300% growth in Embedded Linux

- Interest in Embedded Linux skyrockets

- Whitepaper: Linux's Future in the Embedded Market

- Update on the Embedded Linux Market

Reports and data from past LinuxDevices.com surveys:

- Snapshot of the Embedded Linux Market — May, 2003

- What's so good about open source and Linux — in embedded? (2001 survey results)

- Archive of earlier LinuxDevices.com survey data

Other related stories:

- SPECIAL REPORT: Eclipse consortium turns two

- SPECIAL REPORT: Wind River steps up to Linux

- SPECIAL REPORT: Update on SCO-vs.-Linux situation

- MontaVista on SCO-gate: an embedded perspective

- eCos copyright ownership unified under FSF

This article was originally published on LinuxDevices.com and has been donated to the open source community by QuinStreet Inc. Please visit LinuxToday.com for up-to-date news and articles about Linux and open source.