Mini-ITX spearheads growth in embedded motherboard market

Aug 25, 2010 — by LinuxDevices Staff — from the LinuxDevices Archive — 54 viewsFollowing a recession-caused contraction in 2008 and 2009, the embedded motherboards market is rebounding, with double-digit growth forecast for the next five year, according to VDC Research. Mini-ITX is the most popular form factor, but Nano-ITX, Pico-ITX, and Mobile-ITX will grow rapidly too, the research firm says.

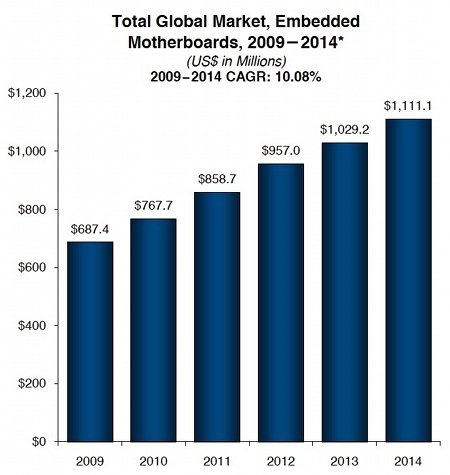

According to VDC Research, the embedded motherboards market contracted from 2008 to 2009 as a result of the industry downturn caused by the recession. However, the firm adds, the market rebounded to $687.4 million globally, and is set for double-digit grown in the next five years, as indicated by the chart below.

The global market for embedded motherboards, 2009-2014

Source: VDC Research

(Click to enlarge)

VDC segments the embedded motherboard market into three classes:

- "desktop class" comsumer/SOHO mothboards that wind up being used in embedded applications

- "embedded class" form factors

- xITX form factors

In its summary of an August 2010 report dealing with embedded motherboards, VDC Research did not detail all the form factors it considers to be part of the "embedded class" (a complete list is, of course, available to those purchasing the document). But devices such as slot SBCs (single board computers), PC/104 modules, mezzanines, and passive backplane architecures are not included, the firm notes.

In fact, VDC Research says embedded motherboards are growing faster than these other types of embedded devices, particularly in China, which will be their "fastest-growing geographic market … in the near term." The market is being driven by a mixture of new "greenfields" applications, conversion of applications previously served by multi-board passive backplane board architectures, and conversion of captive in-house systems at large OEM customers to outsourced merchant motherboard solutions, the firm adds.

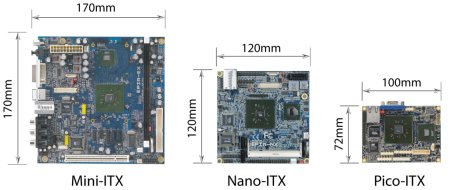

A comparison of three xITX form factors

Source: Via Technologies

(Click to enlarge)

According to VDC, SWAP (size, weight, and power) reduction has become the most important technical requirement in a majority of applications across all vertical segments. As a result, it's said, xITX boards — Mini-ITX, Nano-ITX, Pico-ITX, and Mobile-ITX — are becoming increasingly popular.

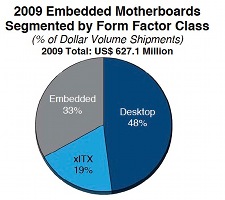

Sales of embedded motherboards by form factor, 2009 (left) and 2010 (right)

Source: VDC Research

(Click either to enlarge)

xITX boards had 19 percent of the market during 2009, and will grow to 24 percent by the end of 2010, VDC forecasts. Last year, dollar volume shipments of Mini-ITX boards surpassed those of ATX, making Mini-ITX the leading embedded motherboard form factor, the firm says.

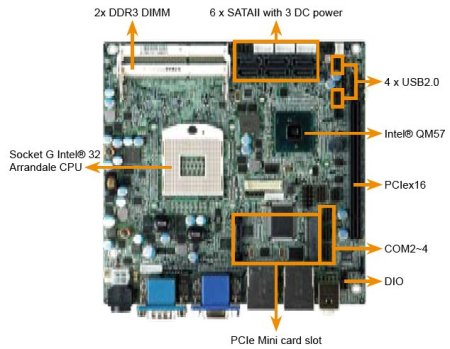

A Mini-ITX board from IEI Technology, the Kino-QM57A

(Click to enlarge)

VDC says shipments of embedded motherboards were worth $627.1 million globally in 2009, excluding the "desktop class" boards that were included in the chart at the beginning of this story. Looking at market share, IEI Technology is said to have come in first (10.3 percent), while DFI (9.2 percent), EVOC Intelligent Technology (7.6 percent), Sun Microsystems (6.4 percent), and Super Micro (5.9 percent) followed.

2009 market shares for embedded motherboard vendors

Source: VDC Research

(Click to enlarge)

VDC Research Embedded Hardware and Systems Practice Director Eric Heikilla blogged:

The level of success that Mini-ITX has been able to achieve in such a fragmented market and in such a short period of time still amazes me every time I look at this market. But really [its] success … is a metaphor for the major trends of the overall embedded market. Mini-ITX was designed specifically to provide low power consumption in a small and compact form factor, and to do so cheaply by creating an active backplane standard that is able to take advantage of the latest x86 silicon solutions.

Further information

VDC Research's embedded motherboards research is part of the "Track 2: Embedded Boards Supply-side Analysis," part of its overall 2010 Embedded Hardware Market Intelligence Service. The August 2010 report costs $6,450, according to the firm.

Overall information may be found here, while a table of contents and an executive summary in PDF format may be found here [PDF link] and here [PDF link], respectively.

The blog entry by VDC Research's Eric Heikilla may be found here.

This article was originally published on LinuxDevices.com and has been donated to the open source community by QuinStreet Inc. Please visit LinuxToday.com for up-to-date news and articles about Linux and open source.