Netbooks still hot, but tablets starting to cut in, says study

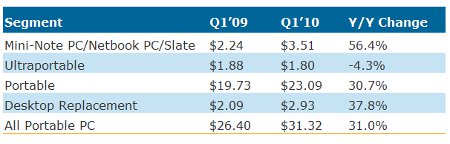

Jun 16, 2010 — by Eric Brown — from the LinuxDevices Archive — 8 viewsFirst quarter notebook PC revenues grew to $31.1 billion — a six percent quarter-to-quarter increase, a 31 percent year-to-year boost, and the best quarter since Q3 2008, says DisplaySearch. Leading the way were mini-note PCs (netbooks), and slates (tablets), which together grew 56.4 percent year-over-year, says the research firm, but tablets are expected to start cutting into netbook sales.

The combined mini-note PC (netbook) and slate (tablet) market grew from $2.24 billion in global revenues in the first quarter of 2009 to $3.51 billion in 1Q 2010, according to the DisplaySearch "Quarterly Advanced Notebook PC Shipment and Forecast Report."

This continues a hot streak reflected in DisplaySearch's analysis of the 2Q market last year, at which point netbook sales were said to be growing at a 264 percent clip. However, DisplaySearch's December report warned that netbook growth would slow in 2010 as the recession receded. Now, netbooks face even more competitive pressure from tablets, says the research firm (see farther below).

While netbooks are identified as having screen sizes ranging from 5.0 inches to 10.2 inches diagonally, the next largest category — ultraportables — offers screens from 10.4 to 12.9 inches, according to DisplaySearch definitions. Next up is portables, which have screen sizes of 13.0 to 16.4 inches, while desktop replacements go from 17.0 to 20.0 inches.

Notebook and mini-note PC revenue y/y change (in millions of USD)

Source: DisplaySearch

(Click to enlarge)

The mini-note PC/slate category benefited from "very strong" growth in Latin America and Asia-Pacific regions, as well as continued growth in China and North America, says DisplaySearch. Shipments of portable-class notebooks also surged in Asia-Pacific, China, and Latin America, "easily passing average market growth rates for the segment," says the study. Meanwhile, shipments of desktop-replacement notebooks were said to have grown quickly in Europe, the Middle East, Africa, and Japan.

ASP not quite so deadly

While the first-quarter's notebook sales reached $31.3 billion — the highest since the third quarter of 2008 — notebook average selling prices (ASPs) were more than 20 percent higher then, says DisplaySearch. Still, ASPs increased this quarter in every category except for desktop replacement notebooks, says the study.

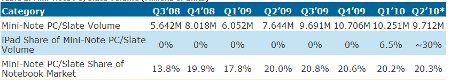

Mini-note PC/slate volume (millions of units); *Q2 2010 data is preliminary forecast

Source: DisplaySearch

(Click to enlarge)

The iPad effect

The momentum appears to be shifting from mini-note PCs to slates, says the study. Only last year, there were no major consumer-oriented slates, and most were targeted at small, vertical markets, says DisplaySearch. Yet in the first quarter of 2010, Apple shipped almost 700,000 iPads into the channel, accounting for 6.5 percent of all mini-note PCs/slates, says the research firm. In the first two months of the second quarter, meanwhile, Apple was said to have sold more than two million iPads.

DisplaySearch expects that the iPad, along with other new consumer tablets, primarily running Android, will continue to increase the slate share of the combined segment. This should exacerbate a gradual loss of share for netbooks, says the study. A wide variety of Android tablets are expected to compete with the iPad this coming holiday season, including the upcoming Samsung Galaxy Tab (pictured).

"The last quarter of 2007 heralded the birth of the mini-note PC (netbook)," stated John F. Jacobs, DisplaySearch director of Notebook Market Research. "Q1'10 signaled the birth of the slate PC, and possibly by extension, the beginning of the end of the mini-note PC (netbook)."

Jacobs appears to suggest that the tablet market will benefit from the online app store paradigm borrowed from major smartphone platforms. "Apple has ported their successful iPhone app business model to the iPad," he stated.

"Android-based phones followed in their footsteps and will surely do the same with slates. The result will be that buyers of slates will be able to take advantage of this a-la-carte software model, adding only the functionality they want on their devices," Jacobs stated.

The netbook's biggest advantage over the tablet is not so much the keyboard as it is the clamshell design itself, Jacobs suggests. "Clamshell-style devices have hinges that are easily manipulated to position the display at an angle that best utilizes a relatively narrowing viewing angle," he added.

Yet, tablets can overcome the lack of a hinge and a cover by offering more robust designs, suggests Jacobs, and they can offer other benefits including better power management. "Slates, with their focus on portability and media consumption and without a clamshell to protect the display, will be used in a wider variety of settings than netbooks," stated Jacobs. "Therefore, they will require very durable, very thin, very bright, very color-saturated displays that consume as little of the battery power as possible."

Availability

Available now, the "Quarterly Notebook PC Shipment and Forecast Report" examines ASPs and system revenue for notebook and mini-note PCs by display size, screen resolution, and region. Report highlights are said to include forecasts by each major criteria, as well as identification of the key variables influencing changing demand patterns.

More information may be found on the DisplaySearch website, here.

This article was originally published on LinuxDevices.com and has been donated to the open source community by QuinStreet Inc. Please visit LinuxToday.com for up-to-date news and articles about Linux and open source.