Study: Wind River outpaces MontaVista

Jul 28, 2009 — by Eric Brown — from the LinuxDevices Archive — 18 views[Updated: 1:30PM] — VDC Research issued a report estimating that Wind River has pushed past MontaVista, taking the top spot among embedded Linux providers. In a separate study, VDC estimates that real-time solutions outperformed the general embedded market last year, with nine percent growth, but that 2009 will be a down year for all segments.

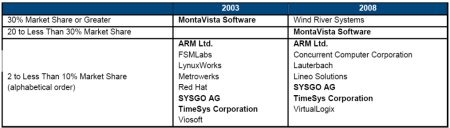

Each year, VDC publicly releases different snapshots of its embedded study, sometimes breaking out embedded Linux vs. the overall market, and in other years focusing on Linux trends and players. This year, the company projected that from 2008 to 2011, the mobile phone and automotive vertical markets will generate the fastest compound annual growth rates (CAGR) in worldwide commercial embedded Linux software and services revenue. VDC also offered a ranking of commercial embedded Linux providers in 2008, compared to their 2003 numbers (see chart below).

Wind River moves to top slot

The new figures, based on market data, surveys, and other input (see farther below) confirm Wind River's promotion of the report last week, saying that the new wholly owned Intel subsidiary represented over 30 percent of embedded Linux revenues last year. Now VDC confirms that second-place MontaVista has fallen from its previous top slot.

Although it did not list exact numbers, VDC estimated that Wind River ranked more than seven percentage points over MontaVista, which was said to have fallen to somewhere between 20 and 30 percent share. The remaining companies, listed in alphabetical order in the chart below, were all said to have ranked between two and 10 percent share (see farther below for more on these companies.)

Top commercial embedded Linux solutions providers, from 2003 (left) to 2008 (right)

(Click to enlarge)

As MontaVista Founder and CTO Jim Ready suggested in an interview with LinuxDevices earlier this week, his chief competitor's Linux business may have also benefited from the ability to steadily migrate customers working with Wind River's larger VxWorks real-time operating system (RTOS) business. This may have helped, for example, to improve Wind River's market share in Carrier Grade Linux (CGL) networking, industrial automation, and automotive products. However, Wind River also appears to have come on fast in smartphones and other mobile devices, where VxWorks is not a factor.

Indeed, in an interview, Chris Rommel, analyst with VDC's Embedded Software and Tools Practice, said that Wind River's VxWorks migrations were only part of the story behind the company's success. "As a much larger company, Wind River has had the resources available to focus substantial investment on their embedded Linux solution product development and marketing," said Rommel. "Their market share has finally started to catch up with their level of investment over the past few years."

|

In other MontaVista-related news today, the privately held company named Dan Cauchy (pictured) as the new VP of marketing. Formerly senior director of Marketing, Cauchy is Chairman of the Linux Foundation Carrier Grade Linux Workgroup.

Intel's impact on embedded device market

This is the first year that MontaVista has fallen from the top ranking of embedded Linux providers since VDC Research published its first Linux report covering the 2000 market, says the research firm.

MontaVista's long-time leadership has been "an especially significant achievement given the number and magnitude of other changes within this market," stated Chris Rommel, analyst with VDC's Embedded Software and Tools Practice. "The embedded Linux ecosystem remains highly fragmented due to the large number of public and commercial distributions and tools available to embedded systems manufacturers. The commercial embedded Linux market, however, has remained a two-horse race over the past few years and Wind River finally caught up. It will be interesting to see if it was just a short sprint or if they can hold their lead going forward."

The report goes on to note that Wind River appears to have maintained its momentum and lead through the first half of 2009. However, the Intel acquisition raises questions as to whether it can continue that lead. As MontaVista VP of Marketing Joerg Bertholdt (who has apparently now been replaced by Cauchy) noted in a recent interview, Wind River risks losing market share among customers who use ARM, PowerPC, and other platforms if the subsidiary is seen to start favoring Intel architecture platforms.

VDC appears to share this concern. The research firm estimates that Intel architecture designs represent less than 15 percent of Wind River's overall revenue. "As a result, a significant amount of Wind River's market share will rest on Intel's ability and willingness (not to mention that of their competitors) to maintain support for non Intel processing platforms," said Rommel. "This acquisition might just provide MontaVista the second wind it needs, enabling them to alter their goto-market strategy and regain lost market share." (For the record, both Intel and Wind River claim they will continue to support all of the company's existing platforms.)

Meanwhile, MontaVista has high hopes for its fast-boot Montabello technology, which is targeted at mobile devices such as mobile Internet devices (MIDs). New VP of Marketing Cauchy was one of the leaders of the Montabello team.

Beyond Wind River and MontaVista: who's who in embedded Linux

Few of the other firms listed among VDC's top embedded Linux providers would be considered "apples-to-apples" competitors to Wind River or MontaVista. Some focus on vertical markets while others concentrate on particular segments of the embedded Linux platform.

Companies that maintained ranking since 2003 include ARM Ltd., which focuses primarily on selling core IP and related software, and is not generally considered a provider of full embedded Linux distributions. Sysgo, meanwhile, sells the industrial-focused ELinOS Linux distribution.

The remaining old-timer is Timesys, which continues to sell its LinuxLink subscriptions for DIY tools based around major silicon platforms. The increasingly automated LinuxLink is looking more and more like an online version of a packaged distribution, yet it appears to maintain its DIY roots and flexibility.

Newcomers to the list since 2003 include German development firm Lauterbach, which primarily focuses on debugging tools, such as its Trace32 PowerTools. The company calls itself "the world largest producer of hardware assisted debug tools." Another new listing is Concurrent Computer Corp., which sells high-performance systems and real-time Linux software aimed primarily at military and aerospace customers. Concurrent Computer's offerings include its iHawk real-time Linux distribution and SIMulation Workbench modeling environment applications.

Another newcomer — Lineo Solutions — is no stranger at all to embedded Linux, having helped pioneer the industry along with MontaVista in the early part of this decade. The Japanese embedded firm launched a failure analysis service this year for embedded Linux developers. This LL-rescue package analyzes embedded stacks and offers corrective action suggestions.

Finally, virtualization vendor VirtualLogix made the list. Although the company struggled financially last year, it appears to have righted itself. Its VLX software is offered in different versions for networking equipment, set-top boxes (STBs), and mobile devices, including mobile Internet devices (MIDs).

Companies that have fallen off VDC's list of top embedded Linux vendors since 2003 include FSMLabs, whose real-time Linux distribution and patented hard-real-time technology was acquired by Wind River in 2007. Other no-shows include LynuxWorks, whose Linux-compatible LynxSecure separation kernel and hypervisor for high assurance systems is aimed at multiple independent levels of security (MILS) applications in the aerospace, government, and defense industries. Viosoft, meanwhile, sells its Arriba Linux Debugger (AlD) and Linux Event Analyzer (LEA) Eclipse plug-ins, among other Linux solutions.

Understandably enough, Metrowerks was dropped from the list, as the tools subsidiary was re-acquired by semiconductor vendor Freescale in 2005 after both firms were cut loose from Motorola. Yet, as VDC noted in last year's report, semiconductor firms themselves are increasingly producing mature embedded Linux distributions for their own platforms, and Freescale has been at the forefront of this effort, thanks in part to its Metrowerks acquisition.

The trend toward semi-based distros, which was remarked upon by MontaVista's Jim Ready in our recent interview, helped push MontaVista to rearchitect its MontaVista Linux 6 distribution along semiconductor architecture lines, letting developers work directly with semiconductor sources while offering integration services and other tools and middleware.

VDC: Real-time outpaces general embedded market

Last month VDC Research revealed a few tidbits from its larger annual embedded device software study, noting that the RTOS market, in particular, has fared better than many other sectors of the embedded software market. "Real-time" is defined broadly enough to incorporate some Linux-based projects, said VDC's Rommel.

The RTOS market was said to have shown a 9 percent growth in revenue over 2007. This year, however, VDC Research expects the real-time industry to follow the larger market in contracting for the first time since 2002.

Stated Rommel, "As a whole, the embedded operating system market has been greatly affected by the reduction in unit shipments over the past nine months due to the substantial percentage of market revenues typically derived from production licenses. However, the magnitude of the recession's impact has been tempered within the embedded and real-time segment due to the growing demands for software-driven functionality coupled with mounting device safety and security considerations and new device requirements."

The good news is that some vertical markets have been less affected by the recession, "while others hold the potential to rebound significantly in 2010," said Rommel. Bright spots are said to include medical devices, which are being driven by the growth in cart-mounted devices and the move toward smaller, mobile form factors.

Retail automation, however, is expected to show the the largest percent decrease from 2008 to 2009 "as retail stores combat falling revenues by limiting capital expenditures on new kiosks and POS equipment," said Rommel. VDC expects the retail segment to "rebound significantly after showing modest growth in 2010 to grow in excess of 20 percent in 2011."

For both the embedded Linux and full embedded studies, VDC's methodology combines supplemental interviews at target firms with models based on supplier shipments, user budget analysis, recent installations, and future purchasing plans. Other key inputs include supplier forecasts of future growth rates, historical data, and economic outlook data, says VDC Research.

Availability

More on the "VDC 2009 Linux in the Embedded Systems Market" study, may be found here. More on the "Embedded/Real-time and Mobile Application Operating Systems, Volume 1" report may be found here. Each of the reports costs $6,450.

Our story on last year's VDC embedded Linux report, which offers links to reports on previous installments over the last decade, may be found here.

This article was originally published on LinuxDevices.com and has been donated to the open source community by QuinStreet Inc. Please visit LinuxToday.com for up-to-date news and articles about Linux and open source.