Snapshot of the embedded Linux market — April, 2007

Apr 26, 2007 — by LinuxDevices Staff — from the LinuxDevices Archive — 19 views The results of LinuxDevices.com's seventh annual Embedded Linux Market Survey are in! This brief summary outlines our interpretation of a few key data points. Overall, we find the results encouraging for embedded Linux, and for companies in the embedded Linux OS and tools market.

The results of LinuxDevices.com's seventh annual Embedded Linux Market Survey are in! This brief summary outlines our interpretation of a few key data points. Overall, we find the results encouraging for embedded Linux, and for companies in the embedded Linux OS and tools market.

digg this story |

This year, our survey drew 932 respondents, or 79 more than last year over a comparable period of time. This alone shows that interest in embedded Linux continues to grow, a fact also reflected by the growing readership of our Website and opt-in newsletter.

As we do every year, we encourage readers to draw their own conclusions from the complete survey response data. Last year's (2006's) summary findings are also available for comparison, along with detailed response data from years past.

Please note that while we make every effort to increase result validity by limiting responses to a single submission per IP address, respondents are self-selected, and we have minimal control over multiple or dishonest voting. Also, our market share results are not meant to reflect upon the commercial success of individual companies. For commercial marketshare figures, LinuxDevices.com recommends VDC, EDC, IDC, ABI, and Gartner, among other capable sources.

And now, our latest observations . . .

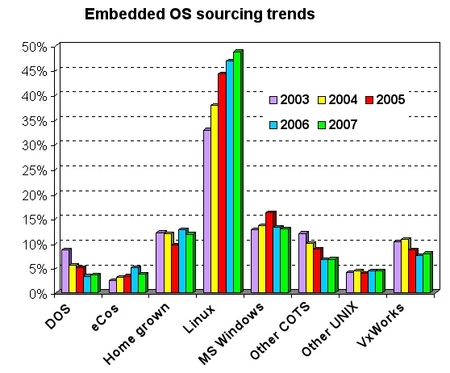

Linux has truly established itself as a viable if not dominant embedded operating system that is used in thousands of new designs each year. Our survey results over the past four years show that Linux adoption is still on the rise, although uptake has certainly slowed since the “boom” years in the early part of the decade. This year's survey results suggest that 49 percent of our survey's respondents have used Linux in embedded projects and/or products — a growth of about two percentage points over last year's results.

Which OSes have been in your (company's) embedded designs during the past two years?

(Click to enlarge)

Our survey results suggest that while Linux continues to gain popularity, most traditional embedded OSes and RTOSes (real-time operating systems) may be losing marketshare. Other than Linux, every other RTOS or OS declined significantly, remained flat, or gained only a statistically insignificant amount.

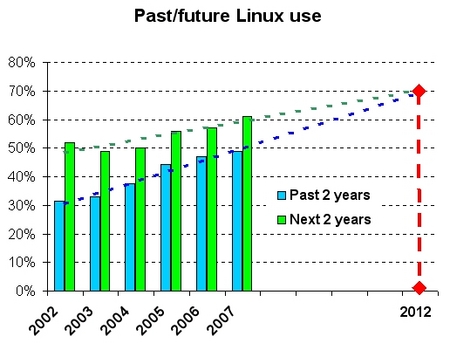

Each year, we ask about planned OS use over the next two years, as well as actual OS use over the previous two. In the early days, planned use far surpassed actual use. Today, as more and more project teams succeed in executing their Linux migration strategies, the Linux “uptake gap” has narrowed dramatically. Trend lines on the chart below suggest that by 2012, actual and planned Linux use will converge, at about 70 percent.

Actual and planned Linux use may converge by 2012

(Click to enlarge)

Interestingly, last year's survey data suggested that embedded Linux's uptake gap would close between 2009 and 2010 at closer to 60 percent. However, some 61 percent of this year's respondents plan to use Linux within two years, compared to 58 percent in the past two years — an increase that suggests Linux adoption may not level off as quickly as previously believed, and may achieve a greater overall market penetration than originally thought.

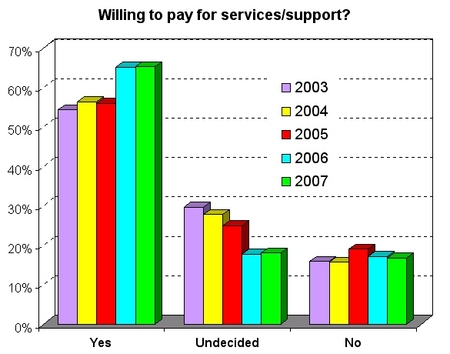

Last year, we found the single most significant trend in our survey data to be a large increase in respondents' willingness to pay for embedded Linux development and support services. That trend held steady this year, as once more, about two thirds said they would definitely consider buying support/services.

Would you consider paying for support or services?

(Click to enlarge)

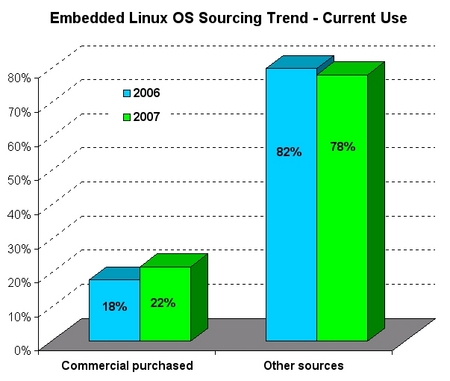

Yet, only 22 percent of respondents reported actually purchasing commercially supported embedded Linux distributions, as indicated in the chart below. Commercial distributors may have far to go before tapping the market's full potential.

That said, the number of respondents who said they purchased their Linux distributions actually grew by about 19 percent compared to last year. Thus, commercial Linux distributors do at least appear to be on the path toward growth.

How did you obtain your (company's) embedded Linux software?

(Click to enlarge)

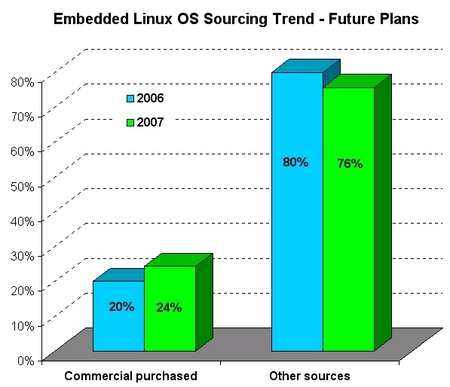

Additionally, results from our survey's question about planned sources of Linux augurs more growth ahead for commercial embedded Linux providers (see chart below).

How do you expect to obtain your (company's) embedded Linux software during the next 2 years?

(Click to enlarge)

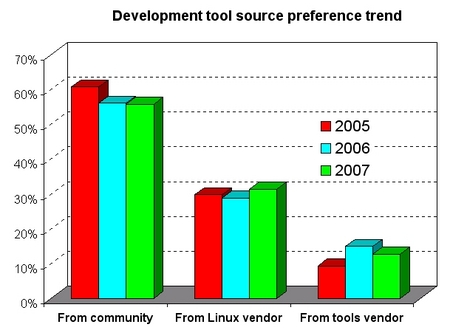

This year's survey data also suggested that more of our readers expect to use tools supplied by commercial Linux vendors, while fewer will use tools from specialized tools vendors, such as RTI and SlickEdit. This result echoes a similar finding from VDC, which in September predicted essentially flat market growth for “unbundled” tools.

What development tools do you expect to use?

(Click to enlarge)

Community-supplied tools, such as vanilla Eclipse, OpenEmbedded, and GNU tools remained the top choice among survey takers. While Eclipse rated last in user satisfaction on an Evans developer survey from last year, our survey respondents — many of whom likely use Eclipse — were generally pleased with tool quality, with all but about 10 percent rating their tools “very good” (28.7 percent) or “acceptable” (55.7 percent). This may reflect the considerable work done by Linux suppliers to adapt the Eclipse framework to device development.

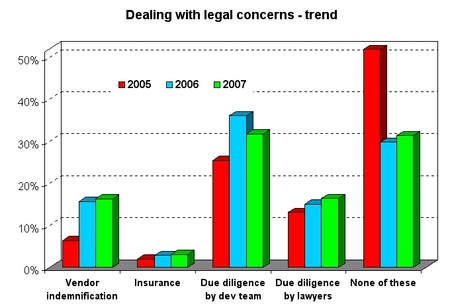

Responses to this year's survey suggest that LinuxDevices readers may be becoming more sophisticated in their understanding of legal risks and responsibilities associated with free software. Fewer reported relegating due diligence to developers, while more reported having actual lawyers perform due diligence. Additionally, slightly more readers than in the past said they were covered by insurance or indemnification from their software vendor.

How is your company dealing with legal concerns relating to embedded Linux?

(Click to enlarge)

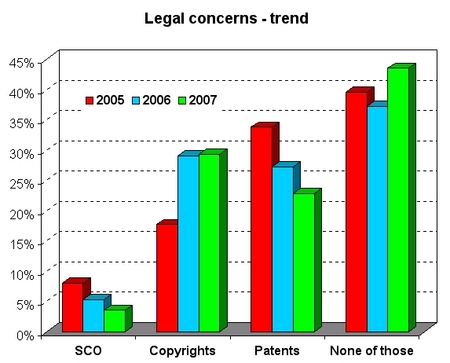

Furthermore, respondents this year worried less about specific legal threats to Linux than in the past. Patent concerns fell sharply, as did concerns about SCO. Copyright concerns grew only slightly. The largest group of respondents — 44 percent — reported no concern over the specific threats we asked about.

Which of these legal issues do you (or your company) feel are a significant concern in using embedded Linux?

(Click to enlarge)

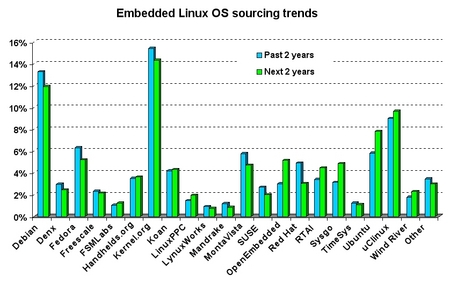

Each year, we try to identify the most popular commercial and non-commercial sources of embedded Linux among our readers. This year's results suggest that little has changed since 2005, when we wrote:

Taken as a whole, the embedded Linux landscape seems most noteworthy for the large variety of popular sourcing options, rather than for the dominance of any single vendor or organization. This suggests that Linux continues to deliver on the promise of vendor neutrality and absence of vendor lock-in, and that embedded Linux technology remains adequately decoupled from the fortunes or failings of any single company or organization.

What sources of Linux were/will be in your (company's) embedded designs during the past/next two years?

(Click to enlarge)

That said, a few distributions fared especially well in this year's survey results, compared to last year. Ubuntu, which we asked about for the first time, debuted with a near six-percent marketshare, suggesting that many embedded developers like to take advantage of the pre-integration offered by popular desktop Linux distributions.

Debian remained the most popular distribution overall, while Red Hat and Fedora both lost marketshare among survey respondents, compared to last year.

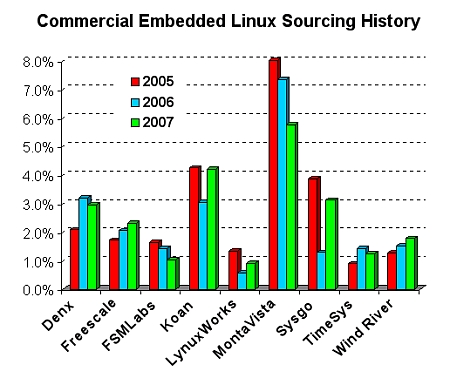

Among commercial embedded Linux distributions, MontaVista remained the top vendor, despite dropping a couple of percentage points. This year, 5.5 percent of respondents reported using MontaVista, compared to about 7 percent last year.

European Linux distributors Sysgo and Koan both grew strongly. Sysgo more than doubled in reported usage, growing from 1.2 to 2.9 percent of respondents, while Koan was reportedly used by 4.1 percent of survey takers, up from 2.9 percent last year. Denx usage dropped very slightly, however.

What sources of Linux were in your (company's) embedded designs during the past two years? — historical trend

(Click to enlarge)

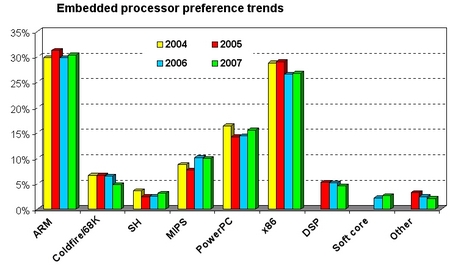

Three years ago, ARM displaced x86 as the embedded architecture our readers reported deploying most often. This year, ARM once again proved the heavyweight, reportedly used by 30 percent of readers, with a full third expecting to use the architecture within the next two years.

Which OSes were/will be in your (company's) embedded designs during the past/next two years?

(Click to enlarge)

Looking at reported architecture usage over the past four years (chart below), ARM's leadership position in the embedded market appears to be fairly well established, with the relative positions of other embedded processors also remaining about the same.

What CPU(s) have been/will be in your (company's) embedded designs during the past/next 2 years?

(Click to enlarge)

As in the past, our annual market snapshot merely touches on the most salient results, in our view, of the latest reader survey. As always, we encourage you to review the complete results from this and other years, and let us know what YOU find interesting, using the Talkback thread below.

Share your response to our observations above, or post your own analysis based on our complete response data, by going here:

Research findings from various analysts during 2006/early 2007

- Device software market growing, globalizing, consolidating

- Report examines Linux's potential in mobile phones

- 200 million Linux phones to ship by 2012

- Embedded market research report considers labor costs

- Linux grabs 30% of China's fast-growing smartphone market

- Linux perceived as Symbian's top threat

- Embedded Linux vendors face market challenges

- Mobile phone shipments neared 1 billion in 2006

- Converged mobile device market grew robustly in 2006

- Embedded systems market to reach $6 billion by 2010

- Slump in non-phone handheld shipments persists

- Smartphones moving into mainstream?

- Report forecasts 2007's hot tech trends

- Traditional PDA market decline persists

- One billion cellphones expected to ship this year

- Linux makes Mot tops in PDA/smartphone growth

- Smartphone market takes off

- Embedded software tools vendors face market challenges

- DSO message not getting through, survey finds

- Home entertainment networks coming on strong

- High-growth handset market faces low-cost dilemma

- Embedded teams typically tiny, survey finds

Older research findings from various analysts:

- Embedded Linux market growing significantly, research firm says

- e-Seminar includes key embedded Linux market data

- Linux now top choice of embedded developers

- Linux poised to dominate world mobile handset market

- Linux trounces Windows Mobile in smartphone shipments

- VDC: mobile dev times longer, less predictable with Linux

- VDC: Microsoft top embedded vendor

- Linux squeezing WinCE, VxWorks out of devices

- Gartner/Dataquest: Embedded Linux now number one in Asia

- EDC: Embedded Linux remains #1 choice of developers — despite tools dissatisfaction

- Findings from EDC's Embedded Developer Survey — August, 2003

- Linux, Windows neck-and-neck in embedded

- Embedded Linux tops developers' 2002 wishlist

- Study finds 300% growth in Embedded Linux

- Interest in Embedded Linux skyrockets

- Whitepaper: Linux's Future in the Embedded Market

- Update on the Embedded Linux Market

Reports and data from past LinuxDevices.com surveys:

- Snapshot of the embedded Linux market — May, 2006

- Snapshot of the Embedded Linux market — May, 2005

- Snapshot of the Embedded Linux market — March, 2004

- Snapshot of the Embedded Linux Market — May, 2003

- What's so good about open source and Linux — in embedded? (2001 survey results)

- Archive of earlier LinuxDevices.com survey data

Other related stories:

- Anomalous embedded Linux survey results reported, retorted

- Two billion unit device market tilts toward off-the-shelf software

- The Great Gadget Smack-Down

This article was originally published on LinuxDevices.com and has been donated to the open source community by QuinStreet Inc. Please visit LinuxToday.com for up-to-date news and articles about Linux and open source.